The Politicization of Old Age Security

How the Bloc is hoisting the Liberals on their own petard.

It might be hard to believe in this polarized age, but I think that some of Prime Minister Stephen Harper’s best speeches were given at World Economic Forum (WEF) events. I say this not to get X/Twitter in a flutter, but because these speeches were delivered to an audience that Harper knew understood economic issues. He was never in Davos for the parties. PM Harper would attend to flex his economist muscles and promote Canada as a great place to invest and do business. One such speech deserves attention now because of political posturing by the Bloc Québécois and a renewed debate about entitlement programs and generational fairness.

In his January 2012 WEF speech delivered shortly after winning his majority government in 2011, Harper spoke about balanced budgets, strong fiscal management, generational fairness and why Canada was well positioned in a changing world. It was vintage Harper making a case for prudence in public finances and the need for western governments to adapt to changing demographic and economic realities.

Regardless of what direction other western nations may choose, under our Government, Canada will make the transformations necessary to sustain economic growth, job creation and prosperity now and for the next generation. That further means two things: making better economic choices now and preparing ourselves now for the demographic pressures the Canadian economy faces…For this reason, we will be taking measures in the coming months, not just to return to a balanced budget in the medium term, but also to ensure the sustainability of our social programs and fiscal position over the next generation…We must do the same for our retirement income system. Fortunately, the centerpiece of that system, the Canada Pension Plan, is fully funded, actuarially sound and does not need to be changed. For those elements of the system that are not funded, we will make the changes necessary to ensure sustainability for the next generation while not affecting current recipients.1

The speech foreshadowed changes the Conservative government would soon make to the retirement income system in Canada to address the “demographic pressures” he warned about. After recognizing that the strong position of the Canada Pension Plan (CPP) meant that no changes were required to it, Harper signaled that non-pension income support programs for seniors funded by general revenues - like Old Age Security (OAS) - needed to keep pace with the country in order to be sustainable into the future.

A few months after this speech, the late Jim Flaherty announced in his budget that the age of eligibility for OAS would change from 65 to 67 and that this change would be phased in over a decade. Canadians who were in their late 50s or early 60s at that time would not be impacted by the change, but those who were born after April 1, 1958 would be. The Canadians impacted would also be allowed to defer their OAS benefit for up to five years and receive a higher payment in return for this deferral. This gradual approach to change was intended to give people adequate time to plan for their retirement and encourage more Canadians to consider working longer if they were able to.

The changes were needed to address the demographic realities that various governments had been largely ignoring since the 1970s. The government needed to reinforce entitlement programs to ensure that they were adequately funded and remove the perverse incentives that encouraged people to stop working. Not only did Canadians need to work longer because they were living longer and would need more retirement income, but they needed to work longer for their own personal wellness. In recent years, clinical studies have shown the positive health outcomes of working longer. On top of this, the Canadian economy needed the ‘retirement age’ to change to reduce strain on the treasury and avoid looming skills shortages that lawmakers were being warned about2. Skills shortages that we are now experiencing3.

Pensions vs. Retirement Income Benefits

The photo of the CBC headline at the top of this essay is actually incorrect. OAS is not a pension. Canadians and their employers do not make compulsory payments into the OAS program like they do for a pension like the Canadian Pension Plan (CPP), the Québec Pension Plan (QPP), or a pension plan they might be fortunate to have in the private or public sectors. OAS is a retirement income benefit that is paid out of the general revenues of the government like any social program. This is a very important distinction that more Canadians need to understand.

The confusion between CPP and OAS both being ‘pensions’ is so commonplace that CBC cannot be faulted for their headline. Government departments and most government communications materials refer to payments made under OAS as an ‘OAS pension’ payment despite the fact they are not. This ‘old age pensions’ misnomer can be traced back to 1927 and the passage of the Old Age Security Act. These pensions were jointly funded by the federal and provincial governments and there was no contribution payment by citizens. The age of eligibility was 70 and there were residency and means testing requirements to qualify for these ‘pensions’, which were really an early form of income support for elderly Canadians. This pension malapropism has lingered, however, and is corrosive to informed public discussion about retirement income supports. This is particularly the case when politicians and the media lean into this misunderstanding.

To understand why the change made by the Harper government was good public policy it is important to understand the history of the CPP and OAS and the demographics they were built upon. I will attempt to do this in some detail without getting into a much wider discussion of additional tax policies designed to help Canadians save for or in retirement. It must be noted, however, that Registered Retirement Savings Plans (created in 1957), Tax Free Savings Accounts (created in 2009) and tax credits like the age amount and others are all important policies used by the federal government to assist Canadians in their retirement years.

History: creation of the CPP and OAS

The CPP and the Québec Pension Plan (QPP) are the only true forms of national government pensions. In 1965, the minority government of Prime Minister Lester Pearson introduced the concept of a national pension plan in collaboration with the provinces. Quebec decided to run their own pension. The QPP is administered by Retraite Québec and contributions and investments are managed by the Caisse de dépôt et placement du Québec (CDPQ). For purposes of this essay, I will only continue to reference CPP, but the two are very similar.

The new pension plan created by the Pearson government was part of a modernization of income supports for seniors put in place by the federal government to replace a series of smaller, non-contributory benefits that were insufficient and becoming financially unsustainable. These precursor benefits were an updated version of the 1927-era ‘pensions’ with a variety of eligibility criteria, but no contribution by the intended recipient.

By 1966, Canada had established a compulsory, contribution based CPP program for working Canadians alongside a revamped Old Age Security (OAS) program to accompany it. CPP eligibility was set at 65, which was lower than the age of 70 that was set back in 1927. This move could be viewed as lowering the ‘retirement age’ to 65 - if you want to call it that - but even using that term is confusing. As of 1975, the ‘retirement test’ eligibility requirement for CPP was eliminated entirely meaning that Canadians could still be working when they began to collect their CPP pension provided they qualified for it.

Under this new retirement income system, OAS was made universally available to Canadian seniors starting at the age of 70. This was positioned as the ‘old age’ threshold given that the CPP was available at 65. At its creation, OAS was indexed to the cost of living at a maximum of two percent per year. Due to pressure on the Pearson minority government, after only two years the government lowered the age of eligibility for OAS from age 70 to 65. There was no clear policy rationale for this change when it was made other than minority politics and pressure from the NDP on the Pearson Liberals. Therefore, by the beginning of the 1970s, Canada had lowered the age for both ‘retirement’ and ‘old age’ to 65 despite the fact that since 1927 the ‘old age’ threshold had been considered to be 70.

The OAS program also included an additional, income-tested supplementary benefit that was intended to be temporary as the new CPP program phased in over the decade. The Guaranteed Income Supplement (GIS) was an addition benefit within the OAS program and was targeted to provide more help to economically vulnerable seniors. It was also funded from general revenues of the government, but the fiscal exposure of the government was limited by the income means test. Just like with the reduction of age eligibility for OAS, by the 1970s the minority governments had also been pressured to make the GIS permanent. GIS continues to this day as the dedicated seniors income support benefit that is intended to address income inequality for seniors.

Demographic Change

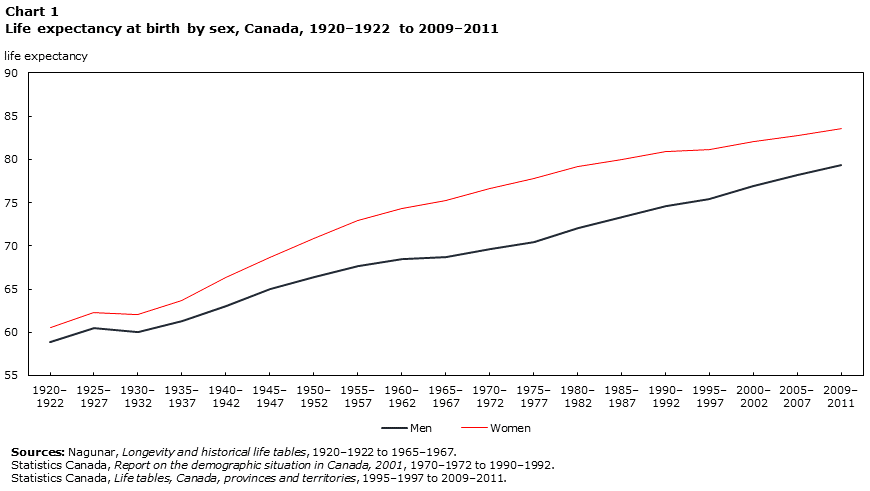

When the CPP was created, life expectancy for a man in his mid to late 40s was 64.7 years4. For women it was 65.3 years. With these statistics in mind, it is much easier to understand why the Pearson government so quickly expanded OAS eligbility and made the GIS permanent. It is also easy to understand how the contribution rate for the CPP could be so low. It looked like the CPP and income support benefits could be funded in a large way by a sustained population boom and a healthy demographic pyramid. Demographic statistics from the 1940s and 1950s, which the CPP was designed upon, also predicted that the vast majority of men [the dominant group in the workforce] would only collect the CPP for a few years before they passed away. Some would not collect CPP at all. While the CPP also had survivor and orphan benefits paid out under the pension plan, these amounts were dramatically lower. This is one of the benefits of large, pooled pension plans. The financial strain on the plan of pensioners who live a very long life is balanced off by people who tragically die without ever drawing a full pension or having received their pension for only a short period of time. Longevity risk pooling, as it is called, means uncertainty about lifespan across the population actually results in a net positive for the plan.

At the time that the CPP and OAS were created, the country had just experienced a post-WWII baby boom and it seemed like there would always be vastly more people working in the economy to help fund the pension plan for seniors at the top of the demographic pyramid. This was the assumption, upon which, the CPP was first built. However, by the time the CPP began paying out pension payments a decade later, these demographic assumptions were already starting to dramatically change. Post-war society in Canada was changing with people beginning to life longer, urbanize and have fewer children. This was not envisioned when the CPP was launched.

In the ninety years between 1920 and 2010, the life expectancy of one-year old boys in Canada increased by 15.0 years and the life expectancy of one-year-old girls increased by 18.6 years5. The 1960s were also a period when the birth rate began a precipitous decline in Canada6. These changes meant that people would be collecting the CPP for a much longer period of time than first forecast and that the pool of working age CPP contributors in the future would decrease. There was also a rise in disability claims under the CPP that were also much larger than initial estimates. With all of the demographic assumptions the CPP and OAS were built upon dramatically changing, governments in the 1970s should have started to adapt to these new realities, but they did not. It is much easier to expand benefit coverage than it is to restrict eligibility or increase contribution rates.

‘Goodbye Charlie Brown’

CPP was established with a contribution rate of 3.6% divided in two between the employee and the employer. Self-employed Canadians would have to pay the full contribution rate to be part of the CPP. The goal of the CPP at its origin was to providing income in retirement of approximately 25% of the average employee’s pre-retirement income. This 25% goal alongside the total number of contributors to the CPP and the life expectancy rates of pensioners were balanced together with the contribution rate to ensure the pension plan would remain sustainable for pensioners in generations to come.

Pressures on the retirement income programs began to mount in the 1970s and 1980s due to the massive demographic changes already discussed, but also due to the fiscal impact of double digit rates of inflation in the economy. The Canadian budgetary deficit was beginning to explode due to higher government spending and pressure from entitlement programs like OAS that were indexed to inflation. These pressures were straining the finances of the nation and making the Canadian economy sluggish and a more uncertain place to invest. Addressing these pressures was one of the first orders of business for the new Progressive Conservative government of Brian Mulroney when it was elected in 1984. They knew they needed to act on these fiscal realities, but they quickly ran headfirst into the politics of it and a women named Solange Denis.

As part of its pledge to wrestle the deficit under control, the Mulroney government planned to limit the indexing of OAS to reduce cost pressures on the treasury. Protests from unions and seniors opposing the changes were fierce and Prime Minister Mulroney was confronted by Ms. Denis on Parliament Hill at the end of his first year in office. She accused him of lying to her about her ‘pension’.

"You made promises that you wouldn't touch anything…you lied to us. I was made to vote for you and then it's Goodbye Charlie Brown" - Solange Denis, 1985

The image of ‘an elderly woman finger wagging at the Prime Minister’ dominated the news and the Mulroney government backed down. The two ironies of this story underscore the political problems we have in discussions about entitlement programs. The Mulroney government was not touching “pensions” at all despite the claims on the placards. On top of this, Ms. Denis was not the senior citizen she was portrayed her to be in the media. Denis was 63 and not even eligible for OAS at the time of the confrontation. In the end, the truth was not as important as the image, and the fact that seniors could be mobilized and leveraged as an important voting group.

Gun shy after this confrontation, the Mulroney government did not really make the serious changes to the retirement income system that were needed to begin to address demographic trends. They did start to make the CPP more sustainable by mandating regular increases to the CPP contribution rate beginning in 1987, which was a positive move. The Mulroney government also allowed Canadians to begin collecting a reduced CPP pension as early as age 60 as part of these changes. They also enhanced survivor benefits. The Mulroney government began to modernize the retirement income system, but the blowback from Solange Denis confrontation meant that they did not move on the more substantive changes needed to make the CPP financial sustainable for future generations.

By the mid-1990s, looming baby boomer retirements led to a crisis surrounding the long-term health of the CPP. The Chretien government began to finally make some of the serious changes needed to sustain and save CPP for future generations. In 1997, they dramatically increased contribution rates for employees and employers to bring the plan back on to a sound footing. They also created the Canada Pension Plan Investment Board (CPPIB) to ensure that returns were maximized over the long-term by building up a fund that could adequately absorb changes to life expectancy and the birth rate without requiring wild swings in contribution rates or eligibility. These changes were opposed by the opposition at the time and politically challenging to implement, but they were absolutely necessary and should be applauded. (For more, see my previous Substack essay on these reforms)

Today: CPP

Thanks to the reforms made by the Chretien government in 1997 and the professional management of the CPPIB over the last few decades, the true ‘seniors pension’ program in Canada is financially sound and is meeting the demographic needs of the baby boom generation and those that come after it. According to Statistics Canada, this summer there were 7,820,121 Canadians 65 or older living in Canada7. 3,404,852 are 75 years of age or older and 4,415,269 are 65 to 74 years old. Given that the majority of Canadians start collecting CPP before the age of 65 and considering there were 6.4 million beneficiaries in 2022, it can be estimated that approximately 7.5 million Canadians will receive CPP benefits this year.

The last actuarial report on the health of the CPP (conducted in 2022) reported that CPP benefits represented a total expenditure of $56 Billion with a forecast of those expenditures to grow to $197 Billion by 2050 when an estimated 9.9 million Canadians will be beneficiaries8. The reforms made a generation ago were a modern reset of the CPP and an example of a responsible governance in the face of changing demographics and the needs of the country. As a result, the CPP is on a sound financial footing and will meet its obligations for the next 75 years9.

Today: Old Age Security & GIS

While the CPP is universal for people enrolled in the plan, there are eligibility rules related to OAS. Canadian citizens or legal residents who are 65 years old can receive OAS if they meet two additional eligibility criteria. The first relates to residence. If the person is living in Canada and receiving OAS, they must also have resided in Canada for at least 10 years since the age of 18. For people who do not live in Canada, to be eligible for OAS you must have previously resided in Canada for at least 20 years since the age of 18. The second eligibility criteria comes in the form of a means test that is premised upon OAS being a targeted benefit. Seniors with high incomes will pay all or part of their OAS benefit back in taxes if their annual income exceeds a certain threshold. This is often referred to as the ‘claw back’. The means testing threshold currently stands at $86,912. This means seniors who are continuing to work past 65 or who have sufficient income from investments or other sources of income (like another private or public pension plan) will not be eligible for all or a portion of the OAS benefit.

The GIS is intended for citizens or legal residents living in Canada who are 65 years or older and receiving OAS. From that basis, an income testing component is used to determine whether the senior is financially vulnerable and therefore eligible for the GIS. The income threshold is presently $22,056 or lower for single seniors. For seniors who are married or common law, the threshold for eligibility varies from $29,136 to $52,848 depending upon the addition of the income from their spouse/partner and their eligibility for OAS. The amount of the GIS benefit varies based on these criteria in a range from an additional $631/month to $1065/month depending upon these financial eligibility criteria. It should also be noted that there is also an GIS Allowance income support payment for seniors aged 60 to 64 with eligibility being once again income tested.

Approximately 7.1 million seniors receive some or all of the OAS benefit representing 91% of Canadian seniors. At the present means testing levels, it is estimated that in 2023 190,000 seniors received no OAS benefit and 385,000 had some level of their benefits clawed back10. This means that with the exclusion of a relatively small number of affluent seniors (approximately 2.6%), most Canadians receive both CPP and OAS income in retirement. Of the 7.1 million seniors receiving OAS, 2.2 million are deemed to be more economically vulnerable and receive the GIS in addition to OAS. This is important to note because OAS is a very broad benefit, so enhancements to it will represent a massive hit on public finances.

Given the size of the baby boom generation and changing demographics, the costs associated with the retirement income system (including tax credits as well) has gone from $80 Billion in 2005 to over $182 Billion in 202111. According to the Office of the Superintendent of Financial Institutions (OSFI), in 2022 $68.3 billion was spent on OAS and GIS payments alone, which represented the largest line item of federal spending. The OSFI report forecasts that this will nearly double to $123.4 billion by 2035, and this estimate does not include the impact of the Bloc Québécois proposals.

Irresponsible Politics Around OAS

The cost of retirement income supports for Canadian seniors and ‘near seniors’ in their early sixties are already a massive portion of federal expenditures. Payments to seniors amounts to more spending than health transfers ($52 billion) and the Child Care Benefit ($28 billion) combined. This massive increase in spending is also happening at a time when health care cost pressures are also rising dramatically as a result of the aging population. The ‘silver tsunami’ warned about by policy experts and demographers in books like Boom, Bust & Echo in the 1990s, is now lapping up against our shores.

Gen X, Millennials and early Gen Z Canadians are being forced to pay for ever increasing seniors benefits and services at a time that the social contract in Canada is changing and making life more difficult for them. These generations - particularly the younger two, are no longer able to enter the housing market as quickly and easily as their parents did. Very few of them will have defined benefit pensions unless they work for the government. They are experiencing higher tuition rates, longer wait times for services, less availability for things like family doctors and rising uncertainty about their future and whether the entitlement programs their taxes are paying for today will even be there for them in the future. They are the ‘generation squeezed’, as one UBC Professor has termed it. When you really drill down on the numbers, ‘squeezed’ may actually be an understatement.

Rather than addressing these fiscal and generational realities and continuing the responsible reforms that Jean Chretien and Stephen Harper began, Justin Trudeau has made things dramatically worse. He has consistently used the large seniors voting block as a political wedge for his advantage despite the fact that he is burdening younger generations with massive debt and a structural deficit that will be hard to address.

The first time the Trudeau Liberals did this was in the 2015 general election. In one of the most irresponsible moves I have witnessed in my decade in politics, Trudeau used Canada’s most popular mayor, Hazel McCallion, to attack the Harper OAS changes. A Mayor who was world famous for one thing - working as a mayor into her 80s and 90s - was criticizing a policy that had as one of its modest goals encouraging people to work two more years to the age of 67. At the age of 67, ‘Hurricane Hazel’ was just getting started, but this incredible irony seemed to be lost on pundits at the time and her well-timed attack ad had a big impact in Ontario.

This move to reverse the OAS changes was so irresponsible that Trudeau’s first finance minister, Bill Morneau, had to disavow his earlier praise of the changes that he had made in a book he co-wrote as a pension manager before running for office. Even the economic guru that Prime Minister appointed in the early years of his government to advise on Canadian competitiveness - Dominic Barton of McKinsey - continued to urge the Trudeau government to stick with the Harper OAS changes. This advice was ignored.

The Trudeau government politicized OAS for a second time in the middle of the COVID-19 pandemic and the 2021 budget that was released a few months before the Liberals called a pandemic election. Despite the fact that the government was deficit financing hundreds of billions of dollars in COVID spending, including a one-time $500 payment to seniors on OAS and GIS, the Liberals wanted to mobilize the large senior voting block just like they had in 2015. To do this, Trudeau promised to increase OAS payments to seniors by 10% on top of what was already being done during the pandemic. Given their massive deficits, the government was likely fearful of a credit rating downgrade on the eve of an election, so they limited the OAS increase to just an older cohort of OAS recipients aged 75 and over.

This crass political move bifurcated OAS recipients for the first time into two groups. Canadian seniors aged 65 to 74 would not receive a boost to their OAS benefit, while seniors aged 75 and older would. There was no real policy rationale for this change other than the general sentiment that older seniors were more vulnerable, but this ignored the fact that the GIS was the appropriate income support benefit to use to help vulnerable seniors. When the Liberals were having difficulty midway through the campaign they went one step further and announced that the government would also increase the GIS by $500 on top of the previously announced changes to OAS. Money was being tossed around to entice voters while the government was running a deficit of almost $400 Billion.

When the Trudeau government announced this move on OAS, I would not match the promise because I still supported getting our system back on track to long-term stability. Instead, in the 2021 election our platform promised a once in a generation increase to health transfers to meet the demographic strains on our health system and promised new targeted supports for families taking care of a senior in the home. Our proposals were more targeted on real needs and had the double benefit of not dramatically increasing the structural deficit while also helping ease pressures on the Long Term Care system.

Hoisted on his own OAS Petard

After playing politics with old age security in two elections, things are coming home to roost for the federal Liberals. With the Conservatives 15 to 20 points ahead in the polls and the NDP walking away from the supply and confidence agreement kept the government in power since 2022, the Bloc Québécois have the Liberals over a barrel. The Trudeau government did not adequately justify the 2021 increase in OAS for seniors over 75 during the 2021 election and Blanchet hammered them throughout the election on excluding this younger cohort of seniors. He is now forcing the issue back onto the agenda because the Bloc have nothing to lose and everything to gain. They will never form government and have a budget and real decisions to make, and Quebec is the province with the largest relative population of seniors, so there are votes for him to find.

The Quiet Revolution in Québec led to the steepest drop in the birth rate in all of Canada. When you combine this with the fact that Québec generally accepts a lower relative number of immigrants than other provinces, you have what amounts to the most challenging demographics in the country. This demographic reality can be seen in the budgetary challenges the Québec government faces on healthcare and long-term care, but also in the pressures on the retirement income system as well. This year, the CDPQ will pay out slightly more in pension benefits than it takes in. It is the first major pension plan to cross this threshold. CDPQ remains well financed and well run, but provinces like Alberta should take heed of the fact that pension plans are not set in stone. Demographics change. Assumptions change. The economy changes. It is far smarter to be part of a much larger and diverse pension fund to benefit from longevity pooling and an overall reduction in risks.

So despite representing the province with the most challenging demographics in the country, Mr. Blanchet and the Bloc are shamelessly chasing a large senior voter block without concern about the financial impact. The Parliamentary Budget Officer has estimated the cost of this Bloc demand to be over $16 Billion dollars over the next five years. This would be yet another massive addition to the structural deficit because this is an entitlement program change that will grow in the years to come. It is also another massively unfair burden being placed upon the shoulders of younger Canadians, whether they are in Montréal or Moncton.

The desire of my own party to have an election has led them to look the other way on this issue, which is part of the reason for this essay. The Liberals desperately need to go, but generational unfairness and responsible fiscal management is far more important. There remains much to be learned from how PM Harper approached these issues.

What Should We Do Now?

Much like the important move to sustain the CPP made by the Chretien government and the smart policy on OAS brought forward by the Harper government, we need to promote generational fairness and fiscal reality in our discussions about saving, retirement planning, taxation and entitlement programs. This means we need to be straight with Canadians and stop pitting one generation of voters against another. I also think we should consider the following six proposals to make this straight talk about sustainable retirement income supports turn into concrete action.

The federal bureaucracy and politicians should stop referring to OAS as a pension. It is not 1927. We need Canadians to understand the role they play in their own retirement and the difference between a pension they contribute to and a benefit they receive that taxpayers fund. This should be mandated on every website and report. Call the CPP or QPP a pension and call all others ‘retirement’ or ‘senior’ income supports.

The Auditor General and PBO should team up every two years to report to parliament on the demographic trends in the country and their impact on government programs and the economy more broadly. This frequency would help educate politicians and the public at large about the sustainability of the programs and elevate the discussion about them. Statistics Canada and many other agencies in the federal government are tracking many of these issues, but none of them report to parliament and empower parliamentarians the same way these officers of parliament do.

We should explore returning OAS to 67 or 68 using a orderly, phased in approach like Harper did in 2012. This is not about settling old political scores, but sustaining this income support programs for future generations and helping people plan better for their own retirement. Other smart countries have done this and Canada should too.

Some provinces have considered creating a supplemental pension plan that would build on the success of the CPP and give millions of Canadians without a workplace pension another source of retirement income. We should have a serious national debate about creating a supplemental pension benefit for Canadians to opt into and receive in addition to the CPP. Only 44% of Canadians have some form of workplace pension and 75% of Canadians are worried about having enough income in retirement12. With these statistics in mind, we should seriously consider this approach.

The Maple 8 Pension funds (the large public pension funds in Canada) should work together and earmark their public advertising dollars towards promoting financial literacy and helping Canadians budget, plan and save. Some provinces are considering adding financial literacy into provincial curricula with Ontario rolling it out as a requirement in 2025. A boost to this initiative from respected investment funds dedicated to the well-being of Canadians in their retirement makes a lot of sense. The funds could partner and expand existing Junior Achievement programming on financial literacy to all schools and provide tools students can use to plan and learn as they grow. To me, it also makes no sense for public pension funds that people are automatically enrolled into to advertise their services beyond simple public awareness. This would be an amazing way to promote a wider public awareness through education.

Finally, I think it is time to dust off a policy I proposed in 2016 when I first ran for Conservative leader. Unfortunately, a pandemic election in 2021 meant that we had to offer a range of other policies, but I think the time is right for this policy. Generation Kickstart was about building generational fairness into the tax system by giving young Canadians a large personal tax exemption (up to $200,000) in their first five years in the workforce to ‘kickstart’ their career by wiping out debt or saving for a home. Canadian society and opportunities for our younger citizens have changed, so our approach to taxation, benefits and generational fairness must change too.

https://globalnews.ca/news/204186/full-transcript-statement-made-by-prime-minister-stephen-harper-at-the-world-economic-forum/

https://www.ourcommons.ca/Content/Committee/411/HUMA/Reports/RP5937523/humarp09/humarp09-e.pdf

https://www.cbc.ca/radio/costofliving/skilled-trades-shortage-cost-of-living-1.7169441

https://www150.statcan.gc.ca/n1/pub/11-630-x/11-630-x2016002-eng.htm

ibid.

https://www150.statcan.gc.ca/n1/pub/91f0015m/91f0015m2024001-eng.htm

https://www.statcan.gc.ca/en/subjects-start/older_adults_and_population_aging

https://www.osfi-bsif.gc.ca/en/oca/actuarial-reports/actuarial-report-31st-canada-pension-plan

https://www.cppinvestments.com/the-fund/our-performance/sustainability-of-the-cpp/

https://lop.parl.ca/sites/PublicWebsite/default/en_CA/ResearchPublications/201940E#a1

ibid.

https://hoopp.com/docs/default-source/about-hoopp-library/advocacy/executive-summary---canadian-retirement-survey.pdf

Wow...what a great and easily understandable summary of senior age programs for income support in Canada. I am affected by this so read the whole thing with great interest. I hope that when the Conservatives are successful in the next federal election, that the leader of the party or whoever makes these kind of decisions in parliament will consider O'Toole for Minister of Economic success or something similar. The Conservatives did the public 'dirty' when they enacted their internal party policy and voted to end O'Toole's leadership. I thought so at the time and continue to see this issue as a negative. Much better though that the lack of any like policy in the Liberal government which has led to the debacle of a continued Liberal PM who few people still believe in as a leader and the party's current ability to mandate that he step down...so we're stuck with him for the time being. I believe that a tightening up of eligibility rules for OAS such as for those who resided occasionally in Canada but now do not. I also believe OAS eligibility should be raised to 70 to really make an impact. That said if this stupid Liberal government that we are currently saddled with gives in to the Blocs demands, well fine. I will benefit from that quite soon but I would also be happy to not have the extra 'pension' funding for the benefit of our country and our children. Good going Erin. I'm so glad you are keeping strong.

This is an uncomfortable topic for those approaching retirement years and seeing their purchasing power go down the drain.

“Freedom 55” is a great idea for those with means, but it is risky for someone who will live to be 98. The OAS isn’t meant to backstop people who live to have as many years of pensionable income as working years contributing towards their retirement.

I think that raising the OAS to age 67 was prudent and done for actuarial purposes. If people are living 15 years longer than they were in 1947, pension earnings should reflect that. There has to be adjustments in the workforce to accommodate older workers. A 67 year old male who has been working construction for years isn’t the same labourer that he was 10 years ago.