In Part I of the Canadian Outlook 2025, I mentioned the possibility that Prime Minister Trudeau would resign and not be in the position to handle the Trump administration in the long-term for Canada. That came to pass on January 6, 2025 when he announced his resignation and prorogation of parliament. I try not to be overly partisan in these essays, but I must say that the country is much weaker and more divided as he leaves office.

I believe the departure of Mr. Trudeau is a positive development when it comes to negotiating with the Trump administration. While we are rudderless as a country as President Trump is inaugurated, I think that is actually preferable to having the Trudeau government limp through the first year of the second Trump Presidency. As I mentioned in my longer Make Canada Serious Again essay, the Prime Minister and Minister Freeland too often used Trump as a foil to demonstrate their progressive bona fides to their base of support. The ‘Welcome to Canada’ tweet was the biggest example, but so was the ‘progressive trade agenda’, the 'feminist foreign policy’ and other examples of where the government put their liberal branding efforts ahead of the national interest in light of the Trump priorities and personality. I called this “virtue-signaling” at the time and it set us back immensely and really poisoned the well for dealings with Trump.

The tariff threat to Canada is the most existential risk we face in the immediate term in terms of economic damage and potential job loss, but I believe that there is an even more serious risk to our economy in the longer term. Our taxes are too high. We are increasingly falling out of step with the United States and becoming less competitive as a result. This could cost us even more economic activity and jobs in the longer term than the impact of tariffs, so we must act swiftly and decisively.

I believe that the tariff threat will likely diminish over time, as Trump extracts some ‘wins’ or concessions from his point of view. He will look for ways to reduce or eliminate many tariffs within a year because of the inflationary risks to the American economy. As I wrote in the first outlook essay, Trump will need to reduce tariffs to keep some critical industry supply chains working and to ensure that inflation does not lead to increasing cost of living challenges for the lower and middle income American families who voted for Trump for economic reasons.

Canada Needs to Lower Taxes Quickly & Strategically

An early American once said that death and taxes were the only certainties in life. As Canada faces the second term of Donald Trump, we can be certain that he is going to lower taxes for American households and corporations in a manner that could cause the slow death of some of our manufacturing industries unless we respond. We must buttress our economy against the Trump tax shock, as his tariff and tax policies combined will be trying to pull investment and jobs out of Canada into the US.

President Trump began a series of tax cuts in his first term resulting in Canada losing its competitive advantage of being a more favorable jurisdiction. We have already fallen out of step with the United States on the issue of corporate and personal taxes, as Trump is poised to go even further. While we can be proud of our greater social safety net and high quality of life in Canada, we must remember that our economies are quite integrated. The United States is not just our main trading partner, but they are also our main competition for investment and talent. Ontario, Alberta and other provinces compete for jobs and investment with Michigan, Texas and other states. Levels of taxation, regulation, talent and the ease of doing business are all factors in the competition for the next big manufacturing plant or the innovator with the next big idea.

The central economic positioning of the Trudeau government has been that they help ‘the middle class and those working hard to join it’. They promised to help the middle class get ahead by forcing wealthy Canadians to ‘pay their fair share’. This rhetoric suggests to Canadians that the ‘wealthy’ and ‘big business’ are somehow bad for the middle class and, by extension, our social cohesion as a country. The fact that ‘others’ were holding you back has been the cornerstone of Liberal communications throughout the course of their government and it has steadily caused division and an erosion of our competitiveness as talent and capital has migrated to the US. This is poised to get worse and is even the subject of taunting from the US President.

Beyond just the economic messaging of the Trudeau government, they have dramatically increased taxes and spending over the course of their term in office. The result is that our corporate and personal tax rates are getting wildly out of step with the United States at a time when President Trump is trying to drive manufacturing investment into the US through his use of tariffs and tax cuts. We must recognize this and adapt by lowering taxes quickly and strategically.

Trump Tax Cuts: Past and Future

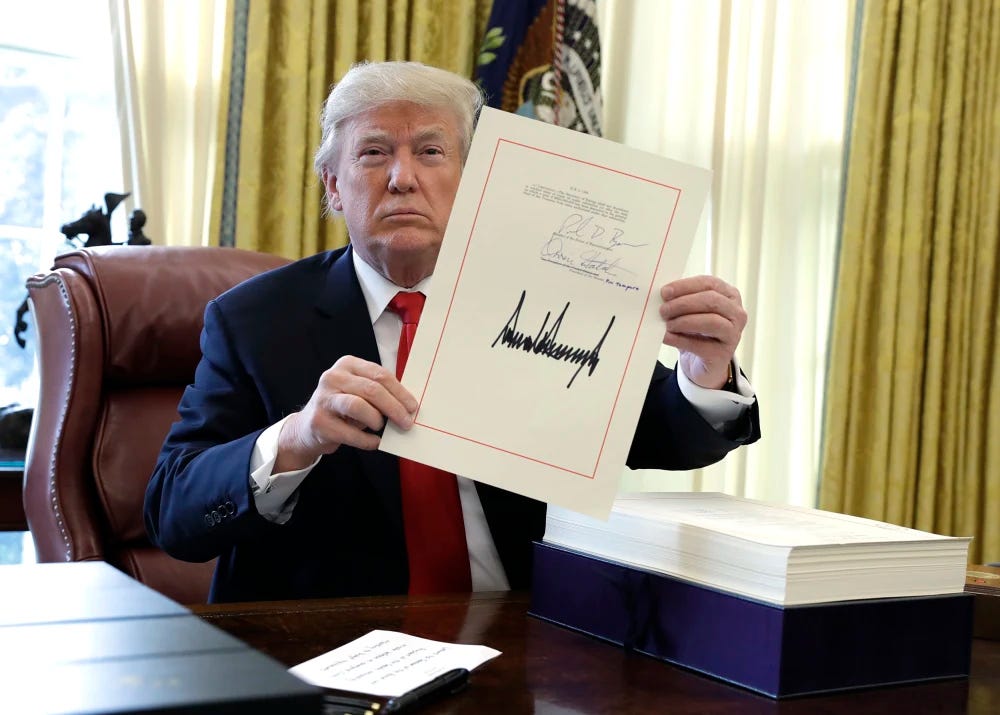

President Trump unleashed a wave of tax cuts - now known as the Trump Tax Cuts - with the passage of the Tax Cuts and Jobs Act in 2017. The Trump Tax Cuts included many changes to both personal income tax and corporate tax. Tax brackets were lowered and deductions increased in a massive fashion. While the Trump administration claimed the move would pay for itself through greater economic activity, the Treasury department and other sources has pegged the cost of the cuts as more than $2 Trillion. These tax cuts ahead of the global pandemic ended up being a major driver of the rapidly increasing US debt load. The Trump Tax Cuts are set to expire in 2025, but the reelection of President Trump and his control of Congress virtually guarantees their extension.

Canada was most seriously impacted by the massive reduction in federal corporate tax rates as part of the Trump Tax Cuts. Trump lowered the federal corporate tax rate from 35% to 21%, where it still stands. With this move, the US went from having a considerably higher corporate tax rate than Canada to one that was virtually the same when many state-province comparisons are considered.

In his third run for president, Trump repeated earlier vows to lower the corporate tax rate even more, but this time he tied it directly to his desire to lure jobs and investment back to the United States. Speaking at the Economic Club of New York in September 2024, Trump pledged to drop the corporate tax rate to 15%, but only for companies that manufactured their goods in the US. This was the central promise of a series of tax incentives for business that Trump unveiled in that speech.

To further support the revival of American manufacturing, my plan calls for expanded R&D tax credits, 100% bonus depreciation, expensing for new manufacturing investments, and a reduction in the corporate tax rate from 21% to 15% solely for companies that make their product in America. You have to make your product in America. If you outsource, offshore, or replace American workers, you are not eligible for any of these benefits. In fact, you will pay a very substantial tariff when a product comes in from another country, that’s made in another country and comes in. There’ll be a big tariff on that product because we want to make our goods in America, and most of them we can.1

Not only will Trump lower the corporate tax rate for manufacturers who make their product in the United States, but he will offer additional support for research and development and a massive 100% bonus depreciation deduction for capital investments in the machinery that corporations will need for expansion of their operations or for the re-shoring of jobs to the United States. This is a massive incentive that will be very attractive to businesses.

The Economic Club of New York speech was largely overshadowed by Trump’s announcement of his intention to create the Department of Government Efficiency (DOGE) and that Elon Musk had agreed to act as its chair, but the tax promises made by President Trump in that speech should be setting off alarm bells in Ottawa and in every provincial capital in this country. When combined with the impact of tariffs, these massive tax incentives will make it increasingly hard for Canadian provinces to compete for investment from their existing manufacturers, let alone attracting new companies to invest in Canada.

Where we Stand Now

Corporate Taxes

It is important to understand where we are at a basic level without getting into the intricacies of tax. At present, the federal corporate tax rate in the US is 21% as a result of the Trump Tax Cuts of 2017. US states have corporate tax rates that range from 0% in states like Nevada and South Dakota to the highest rate of around 9% in New Jersey and Minnesota. Many states have graduated rates depending upon the revenues of the corporation and/or their tax rates in other states of operation.

Canada's general approach to corporate tax is similar to the the US with the combination of federal and provincial taxes being applied. Canada has a federal corporate tax rate of 15% and provincial rates that vary from 8% in Alberta to 16% in PEI. Knowing the importance of manufacturing to its economy and growing competitiveness challenges, the Ontario government recently introduced the Ontario Made Manufacturing Investment Tax Credit which effectively lowers the corporate tax rate from 11.5% to 10% for manufacturers. Quebec has the same overall 11.5% rate. These two provinces represent the bulk of goods manufacturing trade with the United States, where Canadian suppliers are part of integrated supply chains in automotive and several other sectors of the economy.

When you consider the impact of the Trump 15% corporate tax promise, you will see that Canada quickly becomes a much more complex and expensive place to manufacture goods. If you compare an auto parts company in Ontario with a similar one in Michigan or Pennsylvania, the Ontario manufacturer will be facing a 25% corporate tax rate compared to a rate of just 21% in Michigan or 20% in Pennsylvania (by 2031)2. In the last seven years, Canada has gone from being more competitive on corporate taxes to being less competitive, and this does not even include a variety of other measures including the 100% bonus depreciation that Trump is promising companies to build things in America.

Personal Income Tax

Like Canada, the United States has a progressive tax system, which at the federal level has seven brackets ranging from 10% for very low incomes to a highest bracket of 37% for incomes over US$578,000. Like with corporate tax rates, there is a wild variation with income tax at a state level with eight states having no income tax at all to other states with a flat tax structure to others having progressive income tax brackets largely in the low single digits to the the highest rate of 13.3% in California for incomes over US$1 million.

In Canada, the federal government and provinces have progressive income tax brackets with the highest federal marginal tax rate of 33% for incomes over C$246,000. The provinces vary considerably with Alberta having the top rate of 15% for incomes over C$355,000 and Ontario with a top rate of 13.16% for income over C$220,000, but with a surtax on higher incomes that drive the effective rate up even further.

Calculating tax rates given the myriad of brackets, deductions and forms of income can be a long and complex exercise that I will not get into for this essay, but the fundamental point is that the Canadian income tax rates are dramatically higher than the United States. Ontario has a top marginal tax rate of 54%. Alberta has the lowest marginal tax rate in Canada at 48%. Compare this to competitive manufacturing states like Michigan at 37% and Pennsylvania at 36% and you see how significant the difference is between jurisdictions that compete with one another for capital and talent.

Capital Gains

There are a range of other tax considerations to consider from dividend tax rates to tad credits for R&D and other deductions, but the capital gains tax rate is a good measure of how well an economy welcomes risk taking and wealth creation. Again, Canada has become less competitive in the last seven years because of policy choices of the government.

In the United States, there is generally a 20% tax rate for capital gains for higher income taxpayers provided the asset has been held for more than one year. There can be higher rates for short-term investments. In Canada, the Liberal government has been trying to increase the capital gains rate dramatically, but is fortunately running out of runway to do so.

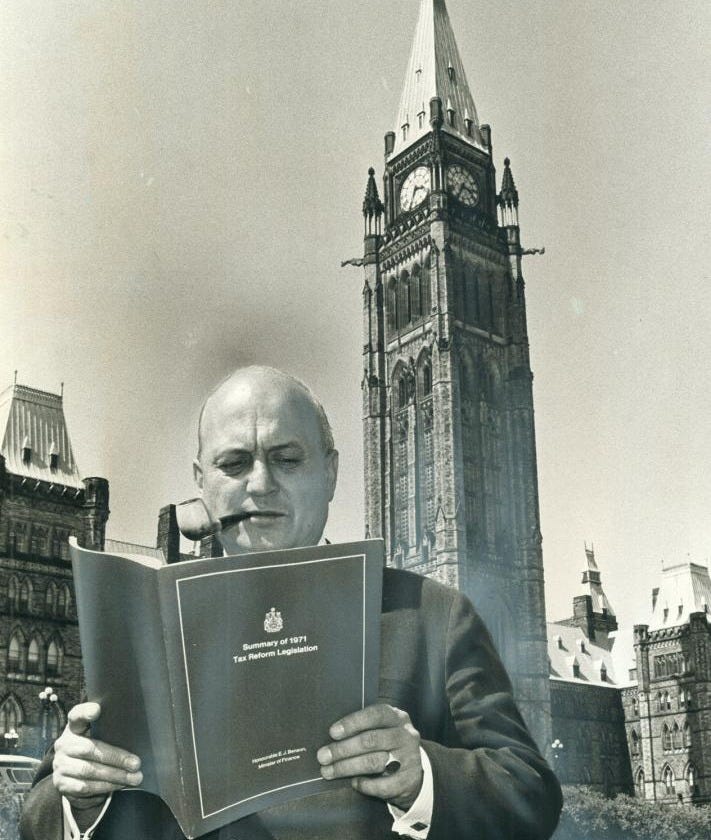

For background, Canada did not tax capital gains at all until 1972 following advice of the Carter Commission on Taxation in 1966. The rationale was that you were investing with after tax dollars, so any gain from your investment - into property, stocks, etc. - would not be taxed as income. Starting in 1972, capital gains began to be taxed at an inclusion rate of 50%. The inclusion rate meant that 50% of the gain was included in your income and taxed at your tax bracket. Capital gains from the sale of the personal residence of the taxpayer was excluded from the application of this tax.

In 1988, the inclusion rate was increased to 66.67%. This was brought in by the Mulroney government, but at the time there was a Lifetime Capital Gains Exemption (LCGE) of $500,000 meaning that middle class Canadians could accumulate some wealth before the inclusion rate applied. The LCGE was eventually lowered to $100,000 and eventually eliminated entirely for regular taxpayers outside of small businesses and farmers. By the 1990s the inclusion rate went up as high as 75% before being reduced back down to 66.67% and eventually 50% again by 2000.

The interesting thing about the capital gains tax in Canada was that the Finance Minister who introduced it, the Hon. Edgar Benson, used that budget to lower the corporate tax rate steadily over the next number of years due to competitive pressures from the United States. He also lowered income taxes on many Canada as part of the measures. At the time it was introduced in Canada, the 50% capital gains inclusion rate was the same capital gains rate that was being applied in the United States.

Today we are wildly out of step with the United States, and unlike Minister Benson, Finance Minister Freeland has been raising taxes at a time that we are becoming less competitive than the United States. In her 2024 Budget, Minister Freeland pledged to increase the capital gains inclusion rate back up to 66.67% for gains above $250,000. Her budget speech was entitled “Fairness for Every Generation”, but it was once again using a divide and conquer approach suggesting that the wealthiest needed to “pay their fair share”. The capital gains increase would put Canada in an even more uncompetitive position on the eve of a massive set of tax reductions in the United States, but fortunately the unpopularity of the Trudeau government may save us from this outcome. [SEE ADDENDUM]

Swift and Decision Action Needed

In my Canadian Outlook Part I, I mentioned that the worst case scenario of the 25% Trump tariff on Canada with full retaliation by Canada on the US would lead to a 5.6% reduction to our GDP. This was based on the general tariff being widely and permanently applied, which I don’t think will be the case at all. Keep that in mind when you consider the impact to our economy could be far worse if President Trump proceeds with the additional tax cuts he promised in his Economic Club of New York speech during the campaign.

In 2018, the Business Council of Canada looked at the impact of the 2017 Trump Tax Cuts given that the competitive corporate tax advantage that Canada had enjoyed for many years was coming to an end. Their report suggested that the Trump Tax Cuts would cost our economy of up to $85 billion over time and lead to the loss of 635,000 jobs. At the time this report was conducted, this impact represented a 4.9% reduction of our GDP and the loss of $20 billion in revenue to the government. If the impact of the original Trump Tax Cuts was a 4.9% hit to our GDP, the additional tax cuts President Trump has promised could be dramatically worse and far more damaging in the long term than tariffs that will likely be temporary.

With this in mind, Canadian political leaders must mount a major tax offensive on a federal and provincial level to ensure that we do not hear a ‘giant sucking sound’ of jobs and investment to the US. More important than picking out which Kentucky bourbon and which California wine we should tariff in retaliation to Trump, we should get our economic and fiscal house in order and make it easy for employers to stay in Canada. We should also be eliminating inter-provincial trade barriers and doing everything we can to promote economic growth.

I believe that Canada should plan to temporarily cut the federal corporate tax rate from 15% to 8% for a few years to assess the impact of the Trump actions in his first years back in office. The provinces should reduce their rates in a similar fashion. While this is a dramatic move, it will be needed to stay competitive. Canada should also match the Trump pledge for the 100% bonus depreciation on machinery and equipment purchases and other measures he brings in to lure new investment to ensure that Canadian elements of the North American supply chain do not slip south. In terms of income taxes, they should also be lowered to ensure the top marginal rate does not exceed 50%, as it presently does in many provinces. At this level, there is a real risk of the loss of entrepreneurs and innovators, who rightly see this level of taxation as excessive. This could be done in a similar fashion with the federal government reducing rates in unison with the provinces to share the burden of remaining competitive. The capital gains inclusion rate should not be touched. Other tax incentives for research and development and business investment should be incentivized for highly competitive fields and to ensure that we can commercialize innovation and scale more businesses in Canada.

The overriding goal for the next couple of years should be to not fall too far out of step with the United States on taxation and watch it very closely so that adjustments can be made based on our fiscal position and US action. Staying not too far off the US approach must be our economic yardstick for the next few bumpy years. In fact, we could take a lesson from Edgar Benson who used that approach back in 1971:

This progressive reduction will bring the general corporate tax rate in Canada to a level below that of the United States, our most important trading partner and business competitor. Despite the many changes in our social and economic structure, we must continue to look to the private sector and our business corporations to provide the jobs for our rapidly increasing labour force and to produce the income required to finance our growing appetite for goods and services. I am confident that this major move to substantially lower the general corporate tax rate will contribute in an important way to making Canada a most attractive place in which to invest, grow and prosper.

-Hon. E.J. Benson, Minister of Finance, June 18, 1971

Addendum:

Despite the fact that the government introduced a Ways and Means Motion in June 2024 related to the Minister’s capital gains tax increase pledge from the April 2024 Budget, there has been no parliamentary approval of this tax increase. The Ways and Means Motion was concurred to in normal course by the House of Commons because procedure dictates that the government must bring forward a bill based on the Ways and Means Motion. The opposition can opposed or attempt to amend that future bill. It is only when that bill is passed that the tax changes will be in effect and obligate Canadians to pay.

While it has been administrative practice for the Canada Revenue Agency (CRA) to use the Ways and Means Motion as the trigger to begin administering the tax change, this has always been done on the assumption that the bill will pass in due course. That is not the case in this situation. The government chose to prorogue parliament until March 24, 2025 and parliament will likely fall shortly thereafter. Due to circumstances beyond their control, the CRA has already began the administration related to a tax increase that will never be passed. While the CRA claims they are following “parliamentary convention”, that is not the case. This is an administrative practice and not a constitutional convention. Given the unusual circumstances and present state of declining trust in our institutions, the CRA should seek and publish legal guidance with respect to their predicament.

https://www.econclubny.org/recent-speakers/-/blogs/donald-j-trump

Pennsylvania is in the process of reducing its corporate tax rate by 0.5% per year reaching 4.99% by 2031.

An excellent piece and again I regret that as a country we wound up with Trudeau et al and not you. Your laser like focus on tax reduction and the need to restructure our country, get rid of internal trade barriers and create an environment friendly to investment is spot on. I have one small grievance with this piece. When we reduce taxes we also need to cut costs. The explosive growth of the federal and provincial bureaucracies over the past 10 years has to be reversed. Otherwise the tax cuts will simply lead to more borrowing. Doubling our debt load in the past 10 years is in my humble opinion just as dire a situation as our taxation.

Interesting, well written and useful.