"Prediction is very difficult, especially if it's about the future."

Danish physicist Niels Bohr once humorously warned about the futility of making predictions, but what would the new year be without the standard forecasting about the year to come? Happy new year to you and your family and thank you for following my Substack.

In previous years, my new year posts would explore issues impacting Canada from a political or policy perspective. From nuclear energy to support for Ukraine to growing polarization and the impact of social media on society, my focus was often on issues that I had advocated on during my decade in politics. This year, I want to be more focused and build on the theme of my Make Canada Serious Again commentary from the fall. The world is changing rapidly and Canada has been out of step and missing opportunities. 2025 offers the year that we can change that trend.

I am very optimistic about the future of Canada. I am not just saying that because I believe there will be a Conservative government elected sometime this year. It is bigger than that. I sincerely believe that if we began to act strategically and start seizing our natural advantages - our people, our freedoms, our alliances and our resources - Canada can prosper and begin to influence the rapidly changing world around us.

With this in mind, my Canadian Outlook 2025 series will focus on three important issues our country will be faced with this year and some quick thoughts on how we can seize the moment. I will also close the series with The Province to Watch - a forecast of how the changing world presents real opportunity for a province that is normally not on the Laurentian radar to shine in the decade to come.

Part I - Trump Tariffs

Off the top we must face the most significan economic challenge that Canada has faced in my lifetime and that will be the impact of Trump Tariffs on the Canadian economy in 2025. They are coming and it is important to understand why and contemplate how we must respond. To do so, we must understand both the reasoning behind the tariffs, and we must learn the lessons from 2018.

Our country is in serious trouble. We don’t have victories anymore. We used to have victories, but we don’t have them. When was the last time anybody saw us beating, let’s say, China in a trade deal? They kill us. I beat China all the time. All the time.1

-Donald Trump launching his Presidential bid, June 16, 2015

When Donald Trump descended down the golden escalator in Trump Tower to announce his first serious run for President it only took forty-five seconds for him to raise the issue that motivates him the most. Trade.

For many years, Trump had regularly railed about what he perceived to be American ‘losses’ in global trade to the point that it was part of his reality star/business titan brand. While his political debut speech started with a salvo against China, the speech included references to Japan, Mexico, Latin America and the Middle East. While Canada was not on the radar in that very first speech, we certainly became a target of his protectionist approach to trade as President.

Therefore, it is a certainty that President Trump will impose some form of tariffs early in his second term. It is also a certainty that a heavily US export reliant Canada will be one of the most seriously impacted countries by a second protectionist Trump administration. In early 2024, as the Presidential election started heating up, Trump was musing about a 10% general tariff on all countries alongside an elevated 60% tariff rate on Chinese goods. This showed he intended to be much more aggressive than he was with the use of tariffs in his first term. At this early stage of the campaign, Scotiabank economists predicted that there would be a 3.6% reduction to the Canadian GDP if this 10% tariff threat was to come to pass.

As the Presidential campaign reached the final stretch in the fall of 2024, Trump became far more aggressive in his rhetoric. Tariffs had become a central part of his Make America Great Again (MAGA) movement and his targeting of the ‘rustbelt’ swing states where this message resonated best. He famously referred to himself as the “Tariff Man” and said that “the most beautiful word in the dictionary is tariff” in an economic address in Chicago. He was now mentioning a 20% general tariff on all countries by this stage of the campaign.

By the time Trump actually won the election, the tariff rates had risen again. As the President-elect he was now speculating about a 25% general tariff against Canada and Mexico. Looking at the impact of these far greater tariff rates, the smart Scotiabank economists predicted that a 25% tariff would lead to a 5.6% reduction to the Canadian GDP, but just a 0.9% hit to the US GDP.

To put all of this into perspective, the 2008/09 Great Recession that rocked the global economy reduced Canada’s GDP by 3.3%. The low end of the Trump Tariff threat is worse than that and the high end would represent one of the worst GDP drops outside of the Great Depression. This is a serious threat to Canadian prosperity, so we must be serious and smart in how we rise to meet it. With tariffs of some sort being a certainty at this point, in my opinion there are only three real questions Canada must address:

What goods may be granted an exemption from the Trump tariff?

How long will be tariffs be in place?

Do we respond with retaliatory tariffs?

1. What goods may be granted an exemption from the Trump Tariff?

It is quite likely that the Trump administration will move quickly to impose tariffs on imports into the US and that it will be a general approach to tariffs on allies of between 10 and 25 percent rising up to 60 percent for rivals like China. It is also likely that there will be some exemptions embedded within the ‘general tariff’ structure based on US self interest and the political imperative of trying to mitigate the inflationary impact of tariffs. With this in mind, there are two strategic parts of our economy where Canada should be - and likely is - backchanneling to the incoming administration to treat these strategic sectors differently.

Auto / Steel / Aluminum

In the first Trump term, Canada was greatly impacted by tariffs applied against the steel and aluminum sectors beginning in March 2018. President Trump relied on section 232 of the Trade Expansion Act of 1962 that permitted him to act unilaterally based on the national security of the United States. Steel and aluminum are critical to the US military and to wider industry and the potential hollowing out of American domestic capacity due to subsidized competitive Chinese products was the basis of the claim that national security was impacted. In his first term, the 232 tariff approach became the preferred Trump trade action to address the ‘losses’ against China that he referenced in his debut speech as a candidate.

Close observers at the time - myself included - warned the Canadian government that tariffs were coming on Canadian exporters despite the reassurance being offered by the Trudeau government that Canada would receive an exemption. The tariffs were ultimately applied against Canada because in the view of the administration Canada was benefitting from being a transshipment country for critical Chinese commodities and that we were doing nothing to address it despite US concerns. The Trudeau government did not act on the transshipment issue until immediately after Trump imposed the 232 tariffs.

This time around, Canada is far better positioned as we approach the second inauguration day for President Trump. The Trudeau government learned the hard lessons from their missteps in 2018. They also watched as the Biden administration maintained an aggressive trade posture vis-à-vis China. So, before the 2024 Presidential election was even decided, the Trudeau government began to align our trade policies with the US. Beginning in August 2024, Canada aligned tariffs with the US with respect to Chinese steel, aluminum and Electric Vehicles. This was a smart move. This time around, there will be no daylight between our countries with respect to China and strategic commodities from steel and aluminum to critical minerals. I believe that this will provide a rationale to take to the Trump administration to treat these sectors differently this time around. Trump can even claim that he ‘brought Canada into line’ with the experience in 2018 and our pre-election move to align with US trade policy.

The unspoken second reason these sectors will likely be treated differently by the US administration is the degree of integration between our two economies with respect to the auto and defence industries. Many American OEMs will need their supply chains to be strong and reliable to take on foreign competitors and to properly ramp up military capability. US auto companies and traditional defence companies are already experiencing business model challenges in the face of heightened competition from China and disruptive technologies. High tariffs on the critical commodities of steel and aluminum would only make their challenges worse and would impact the overall economic competitiveness and defence readiness of the United States.

Therefore, with our strategic commodity trade policies being aligned, Canadian officials could actually use the same ‘national security’ rationale for no tariffs this time that Trump used when he applied the 232 tariffs in 2018. Canada has addressed the main transshipment and misalignment concerns of the US, so that can be a rationale for an exemption. Both countries need to also rebuild our defence and homeland security capacity, so reminding the Trump administration through a renewal of the Canada-US defence production partnership that we have enjoyed since 1956 and the Defence Production Sharing Agreement is in order. This can be accomplished with more defence spending and a more aligned defence approach to the Arctic and to NORAD more broadly.

My prediction is that out of the gate there will only be a 10% tariff applied on steel, aluminum and the auto/defence sector and that this 10% tariff could be quickly removed if border and other Trump frustrations are addressed. My hope is there will be no tariffs in this area, but I think there will be a blanket approach at first with some smaller tariff rates in some sectors like these.

Energy

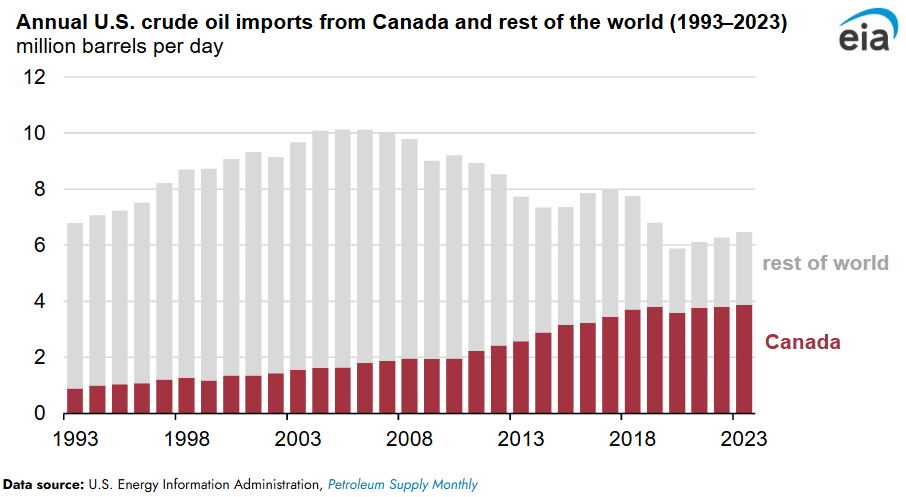

The other critical part of the Canadian economy that I think has the potential to be treated differently is energy. Our two countries depend upon one another for all sources of energy from oil and gas to critical minerals to electricity generation and we have one of the most integrated electricity grids in the world. Despite the best efforts of the Trudeau government to blunt the growth of our oil and gas sector in the last decade, oil exports have risen dramatically over the last few years. Western Canadian Select is a heavy sour crude oil that is suited for the existing American refineries and has historically sold at a discount. A quarter of the oil refined in the US is Canadian oil and this will continue for the foreseeable future. We must leverage this shared area of strategic interest.

While the shale gas revolution has made the US less dependent on foreign energy imports over the last fifteen years, their shale deposits are reaching their peak and experienced their first production decline in 2024. Looking out over the next decade, the Montney and the Alberta Deep natural gas formations in Alberta and British Columbia will be increasingly important to plan for the eventually less reliable shale gas formations in the United States. This means that alignment on oil and gas production and transportation (i.e. Keystone XL) is in our shared interests.

There is also the issue of decarbonization of the North American electricity grid. Since the Canada/US grid is one of the most integrated in the world and there is already a long history of electricity sales flowing both directions across our border, there should be a desire to help ensure that electricity generation is reliable and as low emission as possible. The ability for Canada to add more hydroelectricity that is already in development and plans for Ontario to build more nuclear generating capacity means that Canada can continue to play an important role in an increasingly greener North American electricity grid.

All of this means that Canada needs to distinguish itself from all other countries and promote a Canada-US Energy Pact as the natural extension to our existing NORAD partnership. Energy security is critical to the national security of a country, so we should view building energy reliability and continued collaboration on the electricity grid is being essential for the United States and Canada.

My prediction is that a focus on a Canada-US Energy Pact and working with the Trump administration with the need to exempt energy completely from the Trump tariffs will be successful immediately or very quickly into the second Trump term.

I MUST ADD: Such an approach to energy is also not a new concept. It has been informally happening for decades and promoted as part of Canada-US dialogue when I was the Parliamentary Secretary for International Trade. In 2014, the Council on Foreign Relations report North America: Time for a New Focus promoted such an integrated approach to energy. I spoke about this with one of the report’s authors on my Blue Skies podcast in 2022.

North America 2.0 and Foreign Policy Challenges with Robert Zoellick

Erin is joined by Robert Zoellick, former President of the World Bank and United States Trade Representative, for a discussion on Russia, China and the need for a renewed North American relationship to rise to the challenges facing the democratic world.

2. How long will be tariffs be in place?

With the imposition of some form of a general tariff by the Trump administration being a certainty, the only other unknown beyond the tariff rate is the timeline for their application. How long will the tariffs be in place? Will they be reduced or lifted completely if Canada ‘gets into line’ with President Trump’s concerns about the border, fentanyl and the inadequacy of Canadian defence spending? Or, are some form of tariffs a more permanent part of global trade as the US tries to re-shore American manufacturing.

Personally, I think we will see a little of both. I believe that some tariffs will be lifted or reduced quite quickly, while others will be maintained for several years or the entire Trump term. The reason for this is the fact that Trump has been the ‘tariff man’ throughout his time as a public figure over the last forty years. Since the 1980s Donald Trump has been talking publicly about the United States getting taken advantage of by other nations. His language has been consistent because he truly believes that bi-lateral trade relations are a zero-sum game. One country wins and one country loses. Trump does not realize that global commerce is not a zero-sum game because he does not consider the benefits of more overall wealth creation or other derivative benefits like domestic security, global stability and poverty reduction. To Trump, trade is zero sum and we must view our response with that in mind.

Therefore, I believe the big driver for the timeline for Trump Tariffs will be the impact on inflation and how much the American consumer - the ‘working man’ that Trump likes to fight for - notices the impact of tariffs on their daily life. The non-partisan Congressional Budget Office estimated that Trump’s original 10% general tariff / 60% China tariff proposal would cost average American families an average of $1,560 per year. An independent think tank used the higher 20% / 60% Trump tariff approach for their model that predicted American families would be faced with an additional $2,600 cost per year. A 25% / 60% tariff approach would be even worse, so the inflationary pressures prolonged tariffs would cause would be felt in a major way by the American middle class and likely cause economic and political challenges for the Trump administration.

Therefore, I think Trump will monitor the inflationary impact on consumers very closely and select a range of exemptions and limited time periods for some tariffs to try and mitigate the increased costs to voters in the swing states that elected him. In 2018, he only applied the 232 tariffs for a number of months, so he has acted in this fashion in the past.

By exempting or using a lower tariff rate for energy, auto and other select consumer staples, or by limiting the duration of higher tariff rates for these consumer facing areas of the economy, Trump will likely be able to mitigate the inflationary pressures of the tariffs. He will also be able to point to understandable consumer goods - the gas for your car for example - and say that he is helping the American worker by shielding them from price pressures by reducing or removing the tariffs on these goods.

My prediction is that a considerable number of goods will face tariffs for six to eight months before Trump can claim victory with a few major policy moves (concessions in his language) that would justify a reduction or removal of the tariffs. Some other goods will have tariffs remain in place, which may cause the need for the Canadian government to provide some short-term support to help them survive through a period of uncertainty based on American trade action. More on that in the next section.

3. Do we respond with retaliatory tariffs?

The only remaining question that the Canadian government needs to contemplate is how we behave in the face of Trump Tariffs. Do we retaliate with a dollar for dollar response like we did in 2018? Or, do we try and negotiate, lobby and influence US public opinion to help accelerate the reduction or removal of tariffs that Trump will likely be looking to do at the six month mark, as I explored above? I firmly believe we need to be strategic and disciplined and pursue the latter approach.

In 2018, the Trudeau government announced a series of dollar-for-dollar retaliatory tariffs in response to the 232 tariffs imposed by the Trump administration on steel and aluminum. The Trudeau government assembled a hodgepodge collection of retaliatory tariffs on things like ballpoint pens, bourbon whiskey and toilet paper to respond to the Trump administration. It was symbolic and an emotional response, but not an effective one despite claims by the Prime Minister and Minister Freeland. Members of Congress I spoke to at the time could not even name a single good that was tariffed by Canada.

The reality we face this time is that a much wider set of goods will be tariffed under the Trump 2.0 approach. It will be futile and foolhardy to try and assemble a serious of dollar-for-dollar response, as it will certainly hurt us more than it will hurt the US. It will also guarantee an acceleration from a predictable Trump trade action that could be temporary into a full blown trade war.

The Scotiabank reports I cited above demonstrate the harsh truth of the retaliation scenario. Scotiabank assumed retaliation by Canada in their first modeling of the 10% tariff scenario, but they broke out the differences in their subsequent analysis of the 25% general tariff on Canadian imports. They likely did this because of the profound impact of retaliation of this level. In their model, Canada would experience a 3.8% reduction of GDP if we do not retaliate to the 25% tariffs, but would experience a 5.6% GDP reduction if we do. Inflationary pressures would also be much worse under the retaliatory scenario as well. According to the Scotiabank modeling, the retaliatory tariffs amount to “a negative supply shock and are therefore inflationary, and, as a result, the Bank of Canada would have to increase its policy rate”. For hundreds of thousands of Canadian households, their variable rate mortgages will also be dramatically hit by a retaliatory approach by Canada.

Think about all of this for a moment. Retaliation by Canada will amount to an additional 1.8% reduction to our GDP costing Canada an additional $55 Billion2. It will also hit households as badly as the inflationary increases did in 2022/23.

The smarter option for Canada would be to not retaliate, but to be respond with a disciplined and strategic approach to weathering the storm while fighting for reductions and eliminations. We could address the border issues, ramp of defence spending, explore the Canada-US Energy Pact and engage in strategic dialogue and public relations efforts in the United State, while providing temporary relief to Canadian industry sectors that are dramatically impacted. We know retaliation will hit us harder, so we could use a fraction of the $55 Billion forecast to prop up a few Canadian players while we implement our response.

We can and should speak to the American public alongside the elected officials at various levels of office in the United States, but we should do this in a way that gives President Trump the cover to reduce or eliminate tariffs after Canada responded as a partner. A recent Globe & Mail editorial suggested an approach like this, but I would not frame it as “Trump Tax” as they do. Knowing the transactional nature of the President and his long-standing views on tariffs, the smarter move would be to brand this public relations campaign as ‘Canada is here to help’ or ‘Canada has your back’. ‘We can help bring your gas bill down’ (Canadian Energy). ‘We can help make homes more affordable for new buyers’ (Canadian softwood). ‘We can help keep you safe in your homes’ (NORAD). This builds a narrative of Canada as the trusted partner without inflaming tensions with the administration on a personal level. We are not the 51st state, but we are certainly the neighbour you can count on!

My final prediction is clouded here because of the state of Canadian politics. If Prime Minister Trudeau resigns and we have a Liberal leadership race, we may have several months of retaliation efforts by the Liberal government trying to appear ‘tough’ in the face of unfair US trade action ahead of a fall 2025 election. If we end up having an election this spring, I think our prospects are much better as the new Conservative government will allow for an opportunity to reset the Canada-US relationship and take a much smarter and strategic approach. If I have to predict as I write this on Saturday January 4th, I predict that Trudeau will leave and we may have choppy waters with some retaliation until fall. I just hope we play it smart.

Part II of Canadian Outlook 2025 to come in a few days.

https://time.com/3923128/donald-trump-announcement-speech/

Using latest available GDP figures: https://ycharts.com/indicators/canada_gdp#:~:text=Canada%20GDP%20is%20at%20a,2.951T%20one%20year%20ago.

A well-written and thoughtful essay. I await an intelligent adult government to protect our interests. Definitely not our present one.

Thoughtful, insightful, and clear-eyed; helping ordinary people understand the multitude of moving parts to all of this.

A mature response seems clearly to be the right response. Thank you.